Business & Finance / 02 June 2022

Positioning for interesting economic times

THE SQUIZ

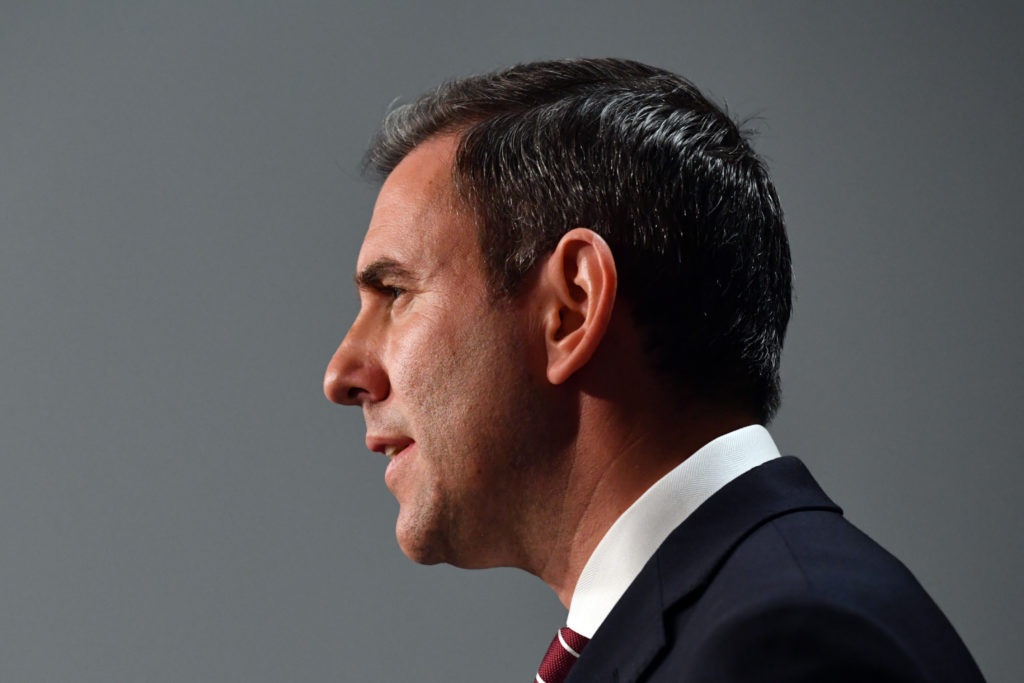

Australia’s economic growth rose to an annual rate of 3.3% in the January-March quarter, the Australian Bureau of Statistics said yesterday. That’s despite the Omicron wave and flooding on the east coast, and it’s better than economists were expecting. Note: it’s not as strong as the 4.2% growth rate we set in October-December, but that was driven by Sydneysiders and Melburnians shaking off the lockdowns of mid last year. And not taking a glass-half-full attitude to the update – Australia’s new Treasurer Jim Chalmers.

WHAT’S GOT HIS GOAT?

He said he was happy to see the “pleasing” demand in the economy (aka we’re out and about buying stuff) and tight labour market (aka pretty much anyone who wants a job has one). But… he says he’s focused on “skyrocketing” inflation, the “spike” in energy and fuel prices, falling real wages, interest rate hikes and $1 trillion in government debt. So yeah, he’s got a few things on his plate… He also says when you dig into the detail, the data released yesterday shows consumption, investment, and exports are weaker than the Coalition forecast before the election. “These national accounts are a glimpse of the mess that the former government left behind for us to clean up,” Chalmers said.

GEEZ THAT SOUNDS TERRIBLE…

There’s no need to head for the hills and go off-grid just yet… Pundits say there’s a bit of grandstanding going on because it’s New Government 101 to talk down what your predecessors left you. That way, if things improve, you’re a genius – and if they get worse, well, we told you things were bad and it’s all their fault… But it’s also undeniable that there are several economic challenges that Team Albanese are about to face – none of them is easy to fix, and many are outside the control of the government. Like soaring global energy and food prices thanks to the war in Ukraine. And like soaring inflation thanks to high energy prices, a workforce that’s still navigating a pandemic, and global supply chain issues. And with national home prices falling for the first time in almost a couple of years and ‘repayment shock’ about to set in for many mortgage holders, there are a lot of expectations for the new government to manage…

Know someone who'd be interested in this story? Click to share...

The Squiz Today

Your shortcut to being informed, we've got your news needs covered.

Also Making News

Get the Squiz Today newsletter

Quick, agenda-free news that doesn't take itself too seriously. Get on it.