AusPol / 25 July 2023

More cash to hide under Oz’s mattress

THE SQUIZ

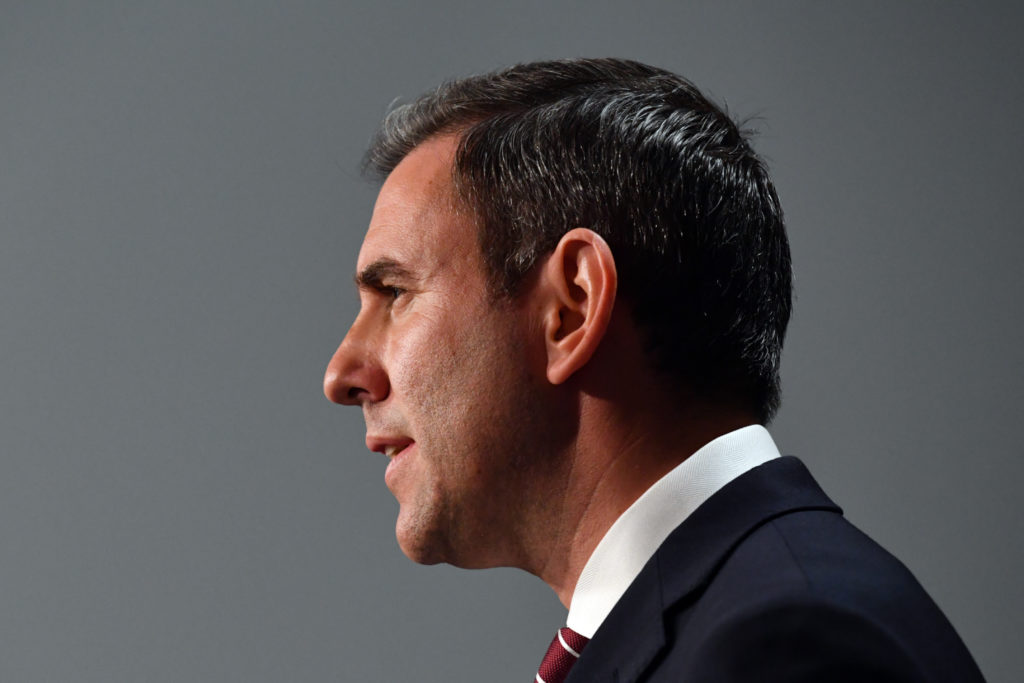

Federal Treasurer Jim Chalmers gave an updated estimate on the government’s 2022-23 Budget outcome and reckons the surplus will be “just likely north” of $20 billion. Whatever the final figure, it’s quite a bit higher than the $4.2 billion surplus projected during the May Budget. Chalmers pointed to our high employment rate (aka high-income tax receipts) as a factor behind the extra $16 billion, but more will be revealed in September. In the meantime, Chalmers also used the same press conference to announce that the Productivity Commission would be getting a new chief…

WHO’S THE NEW GUY?

First, let’s talk about what the Productivity Commission does. It’s a government research and advice body that helps our politicians set economic policy. See, that wasn’t too painful… The Commission will soon be led by Chris Barrett, a long-time public servant/former Labor economics policy adviser. Chalmers says he hopes Barrett will help with policies focused on “getting decent wages growth and lifting living standards over time as well”. Speaking of wages, we also heard Workplace Relations Minister Tony Burke has a plan to help casual workers doing full-time hours transition into permanent roles, complete with guaranteed hours and sick/annual leave. Burke’s proposed workplace laws are a key Labor policy, and we’re expecting to see more before the end of the year.

ANYTHING ELSE?

You didn’t think that was it, did you? New inflation figures are out tomorrow morning… Cue analysts’ recalibrating their forecasts to see if we’re on track for further interest rate rises. There’s no expectation that inflation will be near the 2-3% target set by the Reserve Bank, but cross your fingers that it’s continued to come down from May’s 5.6%. Chalmers was circumspect when asked about it yesterday: “It will be higher than we’d like for longer than we’d like”. Watching keenly will be the Reserve Bank – and consider this your one-week warning that we’re heading towards another first Tuesday of the month (aka interest rate decision day)…

Know someone who'd be interested in this story? Click to share...

The Squiz Today

Your shortcut to being informed, we've got your news needs covered.

Also Making News

Get the Squiz Today newsletter

Quick, agenda-free news that doesn't take itself too seriously. Get on it.